With our last two Anemone issues on brand homogeneity, or ‘blanding’ , behind us, the conversation has kept drifting back to identity, and to the ideological and aesthetic inputs that actually produce a strong brand. We’ve spent a lot of time going back and forth on the forces, incentives, and tradeoffs companies make in the pursuit of brand building.

It probably comes as no surprise to you, that we’re highly opinionated about what a good brand is, and which ones feel increasingly disposable. But rather than continuing to trudge down the sometimes esoteric path of “brands” as a concept—its inputs and its effects on the zeitgeist—we wanted to lean in and get specific.

Because it is one thing to talk about blanding in theory. It is another to look at the brands in your closet, on your phone, and in your daily rotation.

So we’re starting a new series: Behind the Brand.

The goal is simple. We’re going to take brands you likely know and evaluate how well they actually work. We want to look at their systems, decisions, and priorities to understand why you try products, covet them, trust them, and keep them in your life.

Every brand operates with a different purpose, target audience, and set of constraints. And yes, some of why we welcome certain brands into our lives will always be subjective. Taste is taste. But the interesting part is trying to triangulate that subjectivity and build a rubric that allows us to evaluate brands more clearly. This should bring forward a better understanding of the patterns that define good brand behavior, and shed light on the choices that compound, as well as the compromises that start to leak, often before we’re able to articulate them.

Behind the Brand is our attempt to explain it.

There are endless data points you could use to evaluate a brand, so we’re keeping the lens tight. Each brand will be assessed across four categories:

Brand Positioning

What the brand stands for, who it is for, the platform it exists on, and why it believes it deserves to exist in its category.

Cohesive & Aspirational Aesthetics

Whether the brand’s world is legible and consistent, and whether it feels worthy of your attention and your dollars.

Product Communications

How clearly the brand explains what it makes, what it does, and why it is worth choosing, and whether that explanation feels ownable or interchangeable.

Community

Whether the brand builds actual advocacy and attachment over time, or whether it is simply trying to harvest attention.

Each category counts for 25 percent. Together they add up to 100 percent, the idea of a “perfect” brand.

Hopefully this series gives you a more useful way to understand why you gravitate toward certain brands, why others drift out of conversation, why some surge back, and why rebrands tend to arrive when they do.

We’ll take a broad approach across categories. New brands. Legacy brands. Brands past their peak. Brands at the center of the current moment. Brands trying to make themselves matter again.

First up: Clinique.

Founded in 1968 under Estée Lauder, Clinique emerged with a proposition that was unusually specific for its category. Built around dermatologist involvement, allergy testing, and fragrance-free formulations, the brand positioned itself as a corrective to an industry often driven by excess and reinvention. Over time, that focus on credibility and consistency became both its greatest strength and its defining constraint. Clinique is widely recognized and deeply familiar. It’s a brand many people encounter early, step away from, and occasionally return to. That durability, paired with its fluctuating cultural relevance, makes Clinique a useful starting point for evaluating how brand systems hold up over time.

Brand Positioning

Clinique built its reputation as an accessible, dermatologist-developed brand, skincare and makeup that made science feel trustworthy and routine feel manageable. At the time, this was innovative. Clinique translated clinical authority into something usable, demystifying skincare and bringing a sense of order to a category that often felt opaque or indulgent. That clarity mattered. The brand positioned itself as a rational, reassuring choice, offering consistency and safety in a market driven by novelty and promise.

Over time, that accessibility became both its strength and its liability. By casting such a wide net, the brand diluted its sense of focus. Clinique remains credible and widely recognized, but its positioning struggles to answer a sharper question: why Clinique now? The brand lacks a clear creative platform or aspirational promise that extends beyond product performance. In a market crowded with modern clinical brands that pair science with a distinct point of view or worldview, Clinique’s positioning feels largely procedural. Once pioneering, it now reads as static, dependable, and functional, but rarely distinctive or emotionally motivating.

Score: 12.5/25

Cohesive & Aspirational Aesthetics

Clinique’s visual identity remains immediately recognizable. Pastel tones, clean lines, and the signature “C” still signal clarity and trust. At its core, it is a strong visual system. Beyond that core, cohesion begins to thin. Product extensions and seasonal sets stretch the framework without meaningfully evolving it. What once read as striking modern minimalism, intended to project radical simplicity, now feels overly controlled, less an expression of confidence than a brand hesitant to take risks. The result is order without desire.

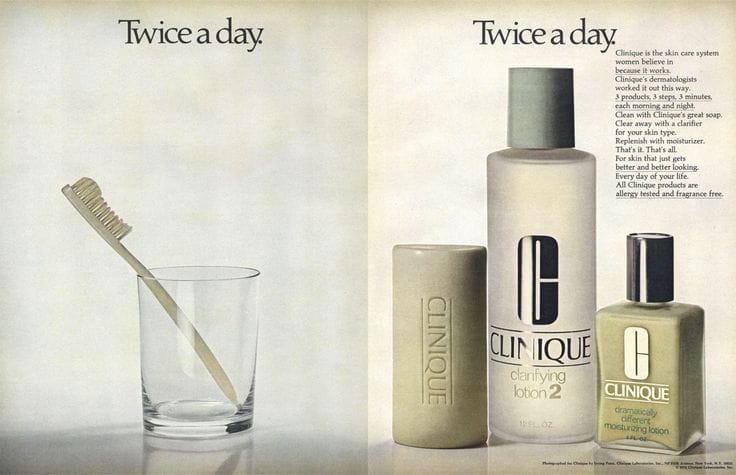

This becomes clearer when you look back at Clinique’s visual history. In the 1980s, Irving Penn’s campaigns established a stark, instructional language tied closely to the brand’s 3-Step System and the idea of “Twice a Day” skincare. They were graphic, direct, and built around a symbolic language. Cleanse. Exfoliate. Moisturize. Simple enough to mirror brushing your teeth. The work rejected glamour in favor of routine, framing skincare as a discipline rather than an indulgence. At the time, that clarity felt radical. It gave consumers a sense of control in a category long built on mystique, and in doing so established a visual and conceptual language that would go on to shape modern skincare marketing.

Irving Penn for Clinique

The challenge now is that this language has been fully absorbed by the category and adopted as baseline. The clean grids, clinical calm, and instructional logic that once felt authored now feel ambient. Clinique hasn’t lost its identity; it just hasn’t continued to evolve it. The brand remains consistent and credible, but that consistency doesn’t translate into aspiration.

Score: 12.5/25

Product Communications

Clinique’s product communications are clear, structured, and benefit-driven, a direct legacy of its dermatologist-developed roots. Naming conventions, routines, and usage instructions are designed to remove friction and build trust. Products explain themselves quickly and predictably, reinforcing Clinique’s long-standing role as a brand that prioritizes reassurance as its primary mode.

The problem is that the simplicity that once built confidence now feels dated. In a landscape shaped by active ingredients, proof-based storytelling, and education-led desire, where science itself has become aspirational, Clinique’s tone reads procedural rather than engaging. Innovation is communicated through the same instructional language regardless of context, flattening distinction and making progress feel incremental.

Clinique explains well, but it rarely connects. Product communications focus on what a product does, but stop short of articulating a stronger reason to choose it now. Familiarity and trust do the heavy lifting, while voice and point of view remain understated.

Score: 12.5/25

Community

Clinique’s relationship with its audience is grounded in habit. Long-time users return because the products are familiar, reliable, and embedded in routine. That loyalty is durable, but largely invisible. It exists at the level of personal use, not shared identity.

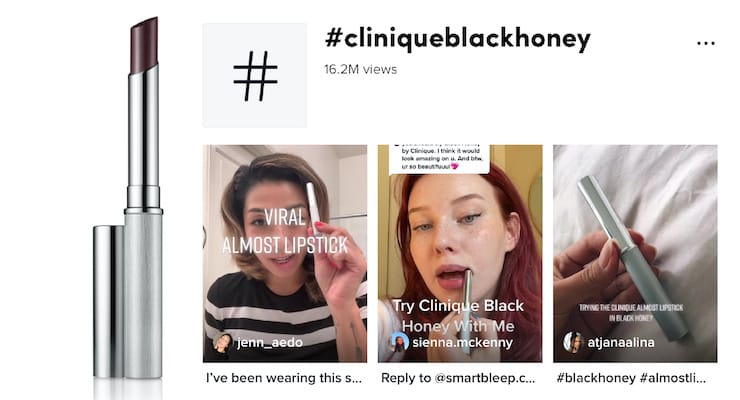

Clinique’s moments of cultural relevance tend to surface sporadically. The viral resurgence of Black Honey on TikTok revealed a reservoir of affection for the brand, fueled in large part by nostalgia. Consumers revisited the product through memory and rediscovery, reconnecting with Clinique as something known and trusted. The moment moved quickly, but it didn’t develop into a sustained presence or a broader community narrative.

Today, Clinique occupies a stable place in the market without generating much ongoing discourse. The brand is widely recognized and quietly trusted, but rarely discussed in ways that build momentum. Community functions as continuity. The connection persists, but it doesn’t grow.

Score: 12.5/25

Clinique Total Brand Score: 50/100

What Clinique needs now isn’t reinvention so much as discernment. The system it created was never meant to be preserved intact; it was meant to be exercised. That requires decisions the brand has been avoiding for some time. A tighter, more intentional assortment. Fewer launches. A clearer hierarchy that restores consequence to the line, instead of distributing importance evenly across everything.

The three-step system, in particular, has more potential than Clinique currently allows. Treated today as legacy architecture, it should be reintroduced as a corrective, even a challenge, in a beauty category crowded with hyper-specific actives, diagnostic theater, and the performance of science. Clinique once offered discipline as a form of clarity. Somewhere along the way, that discipline became procedural, and the cutting-edge authority and radical minimalism that defined it were lost.

And then there’s the visuals. It’s remarkable that a brand that contracted the greatest still-life photographer of all time to produce some of the most groundbreaking advertising in the category now settles for PDP images with no aesthetic conviction or point of view. Still-life photography hasn’t gone anywhere. Given Clinique’s history as a champion of the medium, returning to it should be low-hanging fruit.

Clinique doesn’t lack the materials to lead again. What it lacks is the willingness to use them decisively.